As we write this, the Sensex is at 25,320 points. After having reached an all-time high this year of 29,681 points in January, by the end of the year, looks like the market is going to end up almost 15% down. Needless to say, investors aren’t happy with this ‘correction’. Many are feeling despondent. Others are wondering whether it would be at all possible to make money in the stock market. Of course, the media plays its part (of adding fuel to the fire) by warning that the golden period of the mega bull run is over and investors may need to pull up their socks and tighten their belt to face the ongoing correction.

As we write this, the Sensex is at 25,320 points. After having reached an all-time high this year of 29,681 points in January, by the end of the year, looks like the market is going to end up almost 15% down. Needless to say, investors aren’t happy with this ‘correction’. Many are feeling despondent. Others are wondering whether it would be at all possible to make money in the stock market. Of course, the media plays its part (of adding fuel to the fire) by warning that the golden period of the mega bull run is over and investors may need to pull up their socks and tighten their belt to face the ongoing correction.

We, however, do not subscribe to this point of view. In our opinion, making money in the stock markets comes down to one simple rule – and that is –“Buy Low - Sell High”. However, time and again, we investors find ourselves flouting this norm. When the market is rising, we tend to buy to get in the party. What rises has to fall and when the market follows this rule, we tend to panic and sell in a hurry, often taking losses.

They say, if you can’t take the heat, don’t enter the kitchen. Very true, especially when it comes to stock markets. If you are an investor who only wants to see his investments rising day by day and cannot bear to see the value fall, even temporarily, then trust us, you are destined to be disappointed with the results.

Stock markets, by definition, will rise and fall and rise again only to fall and so on. However, if the economy is strong and corporate earnings show healthy growth, it is but obvious that the same will be translated into numbers sooner than later.

Actually it’s we investors who are shooting ourselves in the foot. What happens when you submit your mutual fund for redemption? The fund manager has to pay you back the current value of your investment. The funds required for this come through the sale of shares. This leads to a further fall in the valuations. When scores of investors act in this similar fashion, imagine the domino effect it would cause. No use blaming the FIIs or China or Europe for that matter. If not causing it, we ourselves are exacerbating the fall.

If anything, this is the time to buy. Once you have invested in a mutual fund, its like entrusting your money to a professional portfolio manager. Let him decide what to sell, what to buy and when to do it. It’s not productive to take the decision on your own.

Fighting the correction

What you do need to do, however, as an investor, is to rebalance your portfolio. Rebalancing means making the modifications required to maintain your asset allocation. Lets say, as per your risk profile, you have decided to invest 70% of your funds into equity and 30% into debt. Lets assume the total invested amount is Rs 5 lakh. This means Rs 3.5 lakh would be invested in equity and the rest in debt. Lets say over a year, the market moves up by 30% and you earn 5% on your debt investments. Rs 3.5 lakh invested in equity would jump to Rs 4.55 lakh and the debt portion would rise to Rs 1,57,500. Now the asset allocation has skewed and the amount invested in equity constitutes 74%.

However, you just want 70% into equity…..time to sell 4% of your capital invested in equity funds and move the same into debt.

And remember the vice versa is also true, but more difficult psychologically. When the equity component falls on account of a falling market, one should actually add equity by buying stocks or equity MFs.

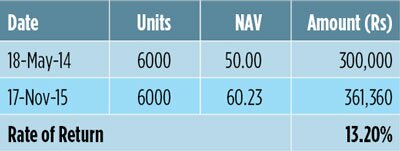

There is yet another risk that an investor takes during an oncoming correction --- that of investing at the peak. For example, take a look at the table beside.

There is yet another risk that an investor takes during an oncoming correction --- that of investing at the peak. For example, take a look at the table beside.

The example assumes that lump sum investment is made on May 18, 2014 when the market is almost at its peak. After which it falls and it takes all of 18 months to recover. The Net Asset Value (NAV) at the beginning is Rs 50 and the NAV after 18 months is Rs 60.23 (an absolute rise of around 20%). The rate of return works out to 13.20% p.a.

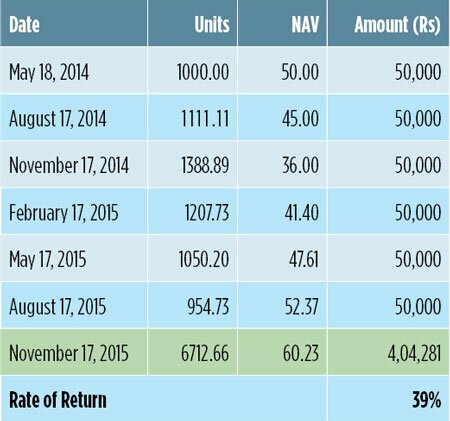

Now, if the same investor, instead of investing at one time, had spread his investments over the same period, the following table explains the result.

Notice that the NAV steadily falls for the first six months of starting the investment. This will happen in a falling market. However, the investor has kept his investment amount constant. After a fall of almost 28% (from Rs 50 to Rs 36), the trend reverses and the market starts rising again and so does the NAV. After 18 months, it reaches Rs 60.23 just like in the previous example. The total invested amount over the 18 month period is the same --- Rs 300,000. However, the rate of return has jumped to 39%!!

Notice that the NAV steadily falls for the first six months of starting the investment. This will happen in a falling market. However, the investor has kept his investment amount constant. After a fall of almost 28% (from Rs 50 to Rs 36), the trend reverses and the market starts rising again and so does the NAV. After 18 months, it reaches Rs 60.23 just like in the previous example. The total invested amount over the 18 month period is the same --- Rs 300,000. However, the rate of return has jumped to 39%!!

The above example showcases the fact that the only way to beat the correction is to fight it. And the way to fight it is not by withdrawing, but by attacking. An analogy may be drawn by thinking of your investment journey as a ship sailing in high waters. There is a storm brewing. You have two options. Carry on and weather the storm to the best of your abilities. Or pull back to the shore.

Coming back to the shore will only mean that you will have to embark upon the journey all over again. And there is no guarantee that you may not encounter another storm. So the best option is to embrace the storm and fight it.

Note that the above numbers are just an example that numerically illustrates the point. And the point is that in real life too, market / NAV valuations follow a similar pattern. The time period may be different – what is 18 months in the above example may be 12 or may be 36 or even more – however, if your invested instrument is appropriate and you have the gumption and the patience to weather out the ‘storm’, your chances of losing are virtually nil.

To Sum

The stock market will be as the stock market is --- it will move up and it will move down. We have two tools to help us in either direction.

When it moves up: Periodically rebalance your portfolio. This will prevent you from being over invested in equity.

When it moves down: Make systematic investments. This will prevent you from being caught in a situation of having invested at what was the peak of that bull run.

In other words, the only way to beat the correction is to look it in the eye and fight it.

The authors are leading financial advisors. Write to them at [email protected]