For most tax payers, income tax is all about Section 80C. Not many know about another important Section called 80G which can serve as a good tax saving option.

What is it?

The deduction to certain funds and charitable institutions is allowed to any taxpayer on the qualifying amount that is limited to 10 per cent of gross total income of the assessee reduced by income deducted under any section. In other words, your donations can be used to save tax for you.

What is the maximum eligible deduction under this section?

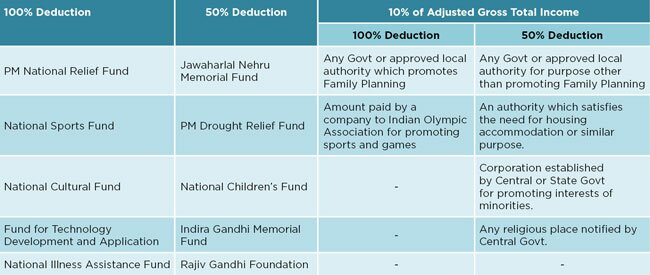

The eligibility of deduction depends on the institution where donations are made. The deduction can be either of the following – 100% of the contribution, 50% of the contribution or maximum limit of 10% of the adjusted gross total income with similar 100% or 50% contributions allowed.

How to claim deduction?

In cases where donation amount has been deducted from the salary of employee and the donation receipt is in the name of the employer, deduction can be claimed through a certificate provided by the employer in this regard. However, in other cases where donation was not through the salary, you need to provide a proof of payment made to the institution. A stamped receipt received from the institution needs to be produced with details such as name and address of institution, donor name, amount, registration details.

What are the conditions to claim deduction?

Deductions u/s 80G can be claimed only if the payments have been made through cheque/net banking. Any payments made in cash or kind (such as clothes, furniture, etc) will not qualify for tax deduction under this section. So, what’s the delay? Make generous donations and get tax deductions.

What are the institutions allowing these deductions?

Note: For the detailed list of institutions, please refer to http://80g.in/