If managing your finances is a skill to live without then using your credit card judiciously could definitely be characterized as the virtue indispensable. Credit cards mean a lot to some – freedom to dine, shop, entertain and splurge —thanks to a string of promotions or benefits such as reward points and cash back offers.

But make no mistake. Apart from the bling factor that comes quintessentially along with credit card spend, how you use credit card promotions has a great say in deciding how much benefits you would get from it.

Take for instance, reward points and cash back offers. A lot of banks are trumpeting flashy advertisements about their credit cards with cash back and reward point offers. Banks can offer cash back from 0.55 up to 20%. Citibank, for instance is currently offering 20% cash back even while you’re dining out, 5% on movie spends, phone bills and utility bills each. If you spend Rs 2,000 on dine-out the bank would pay back 20% i.e. Rs 400. Cool enough! But wait, there’s a catch as the cash back is not unlimited. The bank lists a long list of Most Important Terms & Conditions (MITC) for a customer to be eligible to get the cash back. First, this cash back card charges an annual fee of Rs 500.

Besides, the maximum monthly cash back on on movie ticket purchases cannot exceed Rs 100 per month. Similarly, cash back on utility bill and phone bill payments is subject to a maximum cap of Rs 100 each per month. There’re several other conditions attached.

Take another instance of HDFC Bank. Its Platinum Edge Credit Card offers two reward points on Rs150 spent. You can accumulate the reward points and redeem them as cash back against the outstanding amount on your credit card (100 Reward Points = Rs 40). Similarly, Kotak Mahindra Bank’s Corporate Platinum Card enables a card user to earn reward points that can be redeemed every quarter.

The Good, The bad & The Ugly

Many, in a rush to accumulate lot of reward points, veer toward impulsive buying, blowing their budget and thus mounting heaps of debt on themselves. Experts suggest, one of the ways to get the most of credit card promotions without burning a hole in the pocket is through reading the fine print of the cardholder agreement. This means you’ve to be very clear whether the card is offering cash back at all stores and on all products or it is valid only at select retail stores and only on select products.

Not that these offers are just eyewash. The offers on credit cards are real but to a limited extent, as they hide more than what they promote.

Not all the benefits are rolled in one credit card, and that’s what complicates the matter. In a bid to maximise the benefits, card users get lured to acquire multiple credit cards that could make it difficult to manage credit card debts, experts caution.

So, choose a card that is advantageous to you and that suits your specific needs and preferences.

Cash Back Or Reward Points?

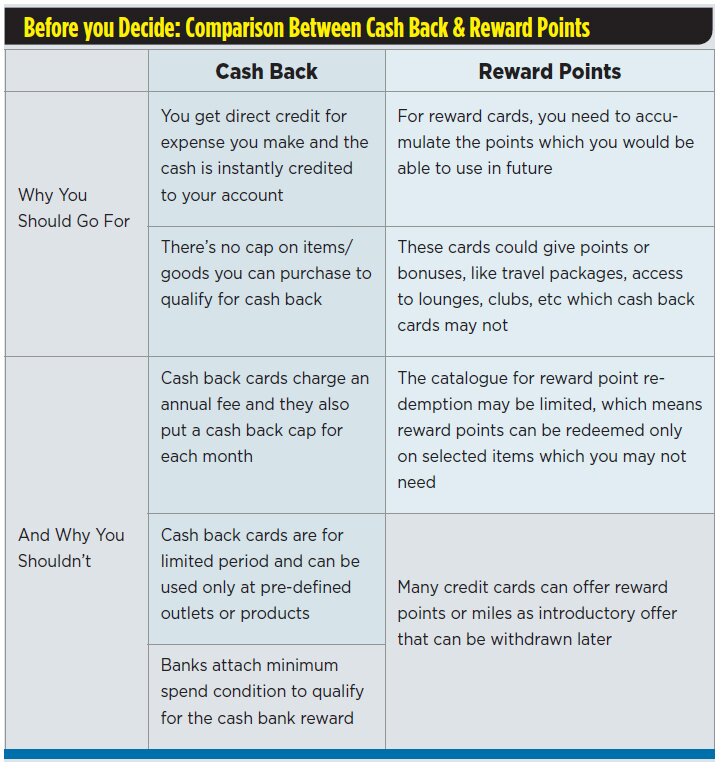

Now comes the crucial question — given a choice which card you would lay your hands on, one that offers cash back or the one that gives you reward points that you can redeem later? No doubt, cash back cards give instant gratification to cardholders, as they give instant benefit compared to reward point cards that take time to accumulate and redeem. But then they also charge fees that would even out the discounts availed.

“In general, a cash back card will be better since it will give you instant discount on purchase you make like fuel etc. However a cash card will charge you annual and other fees which may bring down your actual discount,” says Jitendra Solanki, SEBI-registered investment adviser and CFP, JS Financial Advisors, New Delhi.

On the contrary, he says, a reward point may not charge you but the points need to be collected through your lifestyle purchase which may or may not happen. Also reward points can be redeemed only with selected items which you may not need. So in comparison a cash card will look better but there are strings attached which should be looked in detail.

Nevertheless, you should choose between a reward card and a cash back card depending upon your age, income, expenditure and lifestyle, argue experts. This means a card user who is a frequent flier would be keener to accumulate air-miles than a user who’s not a frequent air traveller.

“Both these benefits are essential and it would depend on the lifestyle and the spending habits of the user on what makes the credit card special. The benefit of the reward would differ from user to user. A user who would value money immediately would look at going for cash back option which is instant credit to your account wherein a customer who wish to gather miles would be keen to accumulate the same for concession/free air travel,” maintains Rajiv Raj, Co-Founder & Director, CreditVidya.

So, it’s a bit difficult to say which of the two offers makes a credit card great — the lure of cash back or the reward points it gives. It’s really tough to say as the choice depends on the card user’s needs and spending habits. Both types of cards have their individual terms and conditions, both impose restrictions on the usage and both put a cash back and reward points cap. It’s entirely the prerogative of the card user to use between the two. After all, there’s no credit card that’s best for every card user.